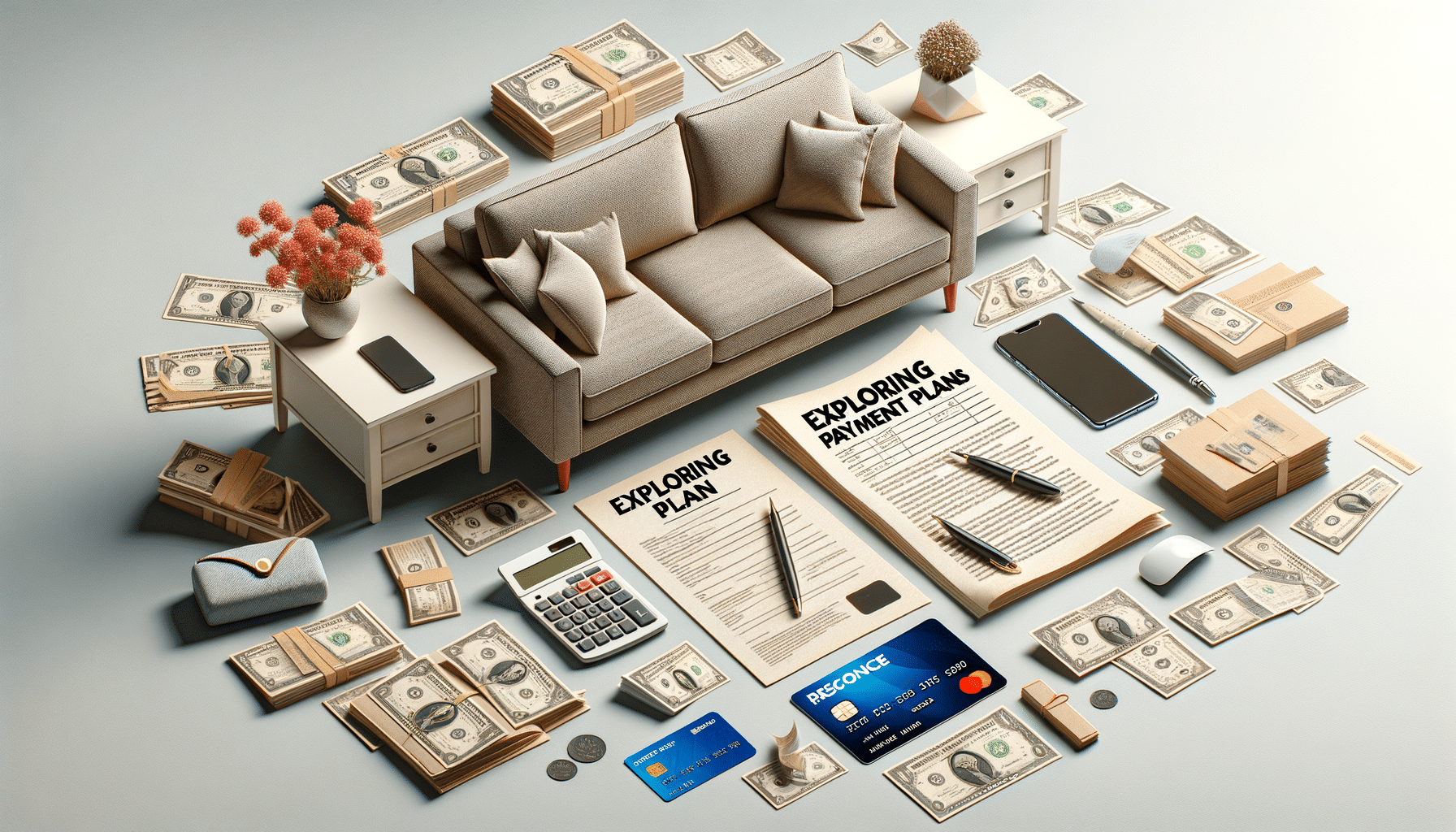

Exploring Sofa Payment Plans: A Guide for Smart Shoppers

Introduction to Sofa Payment Plans

In today’s consumer-driven world, the flexibility of payment options can significantly influence purchasing decisions, especially when it comes to larger investments like furniture. Sofas, being a central piece in any living room, often require thoughtful consideration regarding not just style and comfort, but also affordability. This is where sofa payment plans come into play, offering a practical solution for those who wish to spread the cost over time. Understanding these plans can empower you to make informed decisions, ensuring that you enjoy your new furniture without financial strain.

Types of Sofa Payment Plans

Sofa payment plans vary widely, catering to different financial situations and preferences. Here are a few common types:

- Interest-Free Financing: These plans allow you to pay off your sofa over a set period without accruing interest, provided you meet the payment deadlines.

- Deferred Payment Plans: These allow you to delay payments for a specific period. However, interest may be charged if the full amount isn’t paid by the end of the term.

- Rent-to-Own: This option lets you rent the sofa with the option to purchase it after a certain period. It’s often more expensive in the long run but offers flexibility for those unable to commit immediately.

Each plan has its own advantages and potential pitfalls, so it’s crucial to read the fine print and understand the terms fully before committing.

Benefits of Using Payment Plans

Opting for a sofa payment plan can offer several benefits:

- Budget Management: By spreading the cost over several months, you can manage your budget more effectively without having to make a large upfront payment.

- Immediate Enjoyment: Payment plans allow you to enjoy your new sofa immediately, rather than waiting until you have saved up enough money.

- Building Credit: Successfully managing a payment plan can help improve your credit score, as long as payments are made on time.

These benefits make payment plans an attractive option for many shoppers, particularly those looking to furnish a new home or upgrade their living space.

Potential Drawbacks and Considerations

While sofa payment plans offer numerous benefits, there are also potential drawbacks to consider:

- Interest Rates: If not interest-free, these plans can accrue significant interest, increasing the total cost of the sofa.

- Late Payment Penalties: Missing a payment can result in fees or higher interest rates, affecting your overall financial health.

- Commitment: Entering a payment plan is a financial commitment that requires consistent income and budgeting discipline.

It’s important to assess your financial situation and ensure you can meet the payment obligations before entering into a plan.

Making the Right Choice

Choosing the right sofa payment plan involves careful consideration of your financial situation and long-term goals. Here are some tips to help you decide:

- Assess Your Budget: Determine how much you can afford to pay monthly without affecting your other financial commitments.

- Compare Plans: Look at different plans offered by various retailers, comparing interest rates, terms, and conditions.

- Read the Fine Print: Always read the terms and conditions thoroughly to avoid any unexpected surprises.

By taking these steps, you can ensure that you choose a payment plan that aligns with your financial situation and allows you to enjoy your new sofa stress-free.

Conclusion: Navigating Sofa Payment Plans Wisely

In conclusion, sofa payment plans can be a valuable tool for smart shoppers looking to enhance their living spaces without financial strain. By understanding the different types of plans available, weighing their benefits and drawbacks, and making informed choices, you can enjoy the comfort and style of a new sofa while maintaining financial stability. Remember, the key to a successful purchase lies in careful planning and consideration of your long-term financial health.