Exploring Rent to Own Home Programs: A Path to Homeownership

Introduction to Rent to Own Home Programs

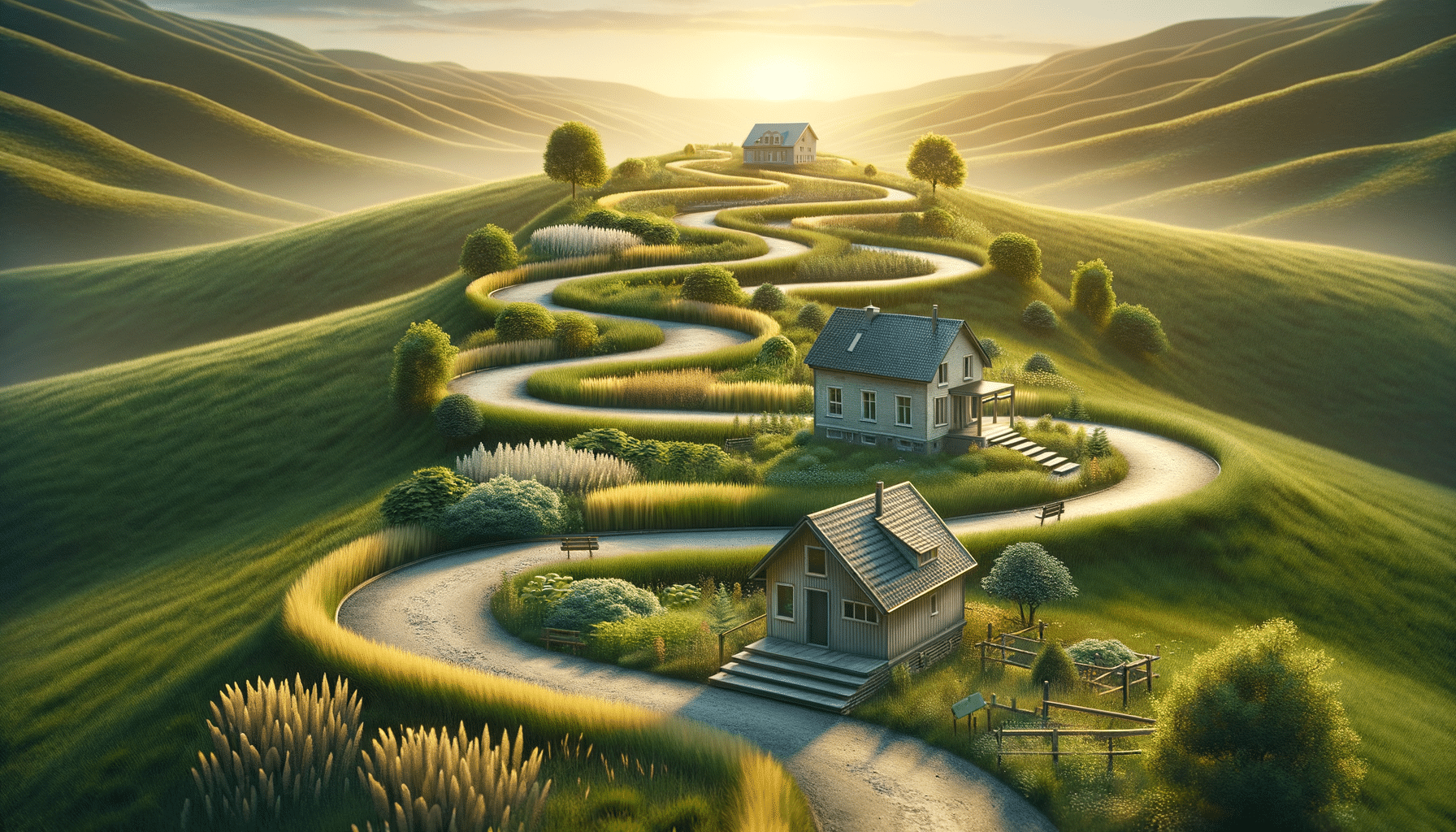

In the quest for homeownership, many potential buyers face the hurdle of saving for a substantial down payment or securing a mortgage. Rent to own home programs offer a unique solution by blending the flexibility of renting with the opportunity to purchase the property. These programs are gaining popularity as they provide a viable pathway for individuals who might not yet qualify for traditional financing. By understanding how these programs work, potential homeowners can make informed decisions about their housing options.

How Rent to Own Programs Work

A rent to own agreement typically consists of two parts: a standard lease agreement and an option to purchase. During the lease period, tenants pay rent as usual, but a portion of this payment is often credited towards the future purchase of the home. This arrangement allows tenants to gradually build equity while living in the property. The option to purchase gives the renter the right, but not the obligation, to buy the home at a predetermined price after the lease term ends. This setup can be particularly beneficial for individuals working to improve their credit scores or save for a down payment while already residing in the home they wish to buy.

Benefits of Rent to Own Agreements

Rent to own agreements offer several advantages that make them appealing to prospective homeowners. Firstly, these programs provide a chance to lock in a purchase price, which can be advantageous in a rising real estate market. Secondly, they offer an opportunity to test out the neighborhood and the home before making a long-term commitment. Thirdly, rent to own programs can be a stepping stone for those who need time to address financial issues or build their credit. By living in the home, tenants can also identify any potential problems with the property, ensuring they make a well-informed purchase decision.

Challenges and Considerations

While rent to own programs present numerous benefits, they also come with challenges that potential buyers should consider. One major consideration is the risk of not completing the purchase. If the tenant decides not to buy the property or is unable to secure financing at the end of the lease, they may forfeit any premium payments made towards the purchase. Additionally, these agreements often require careful negotiation to ensure fair terms for both parties. It is crucial for renters to thoroughly understand the contract details, including the purchase price, maintenance responsibilities, and any penalties for breaking the lease.

Is Rent to Own Right for You?

Deciding whether a rent to own program is suitable depends on individual circumstances and goals. For those committed to homeownership but facing financial barriers, this option can be a practical stepping stone. Rent to own arrangements can be particularly beneficial for individuals with fluctuating income or those in the process of rebuilding credit. However, it is essential to conduct thorough research and possibly seek professional advice to navigate the complexities of these agreements. By weighing the benefits and potential drawbacks, prospective homeowners can determine if this path aligns with their long-term objectives.