Affordable Car Insurance Full Coverage Seniors over 70

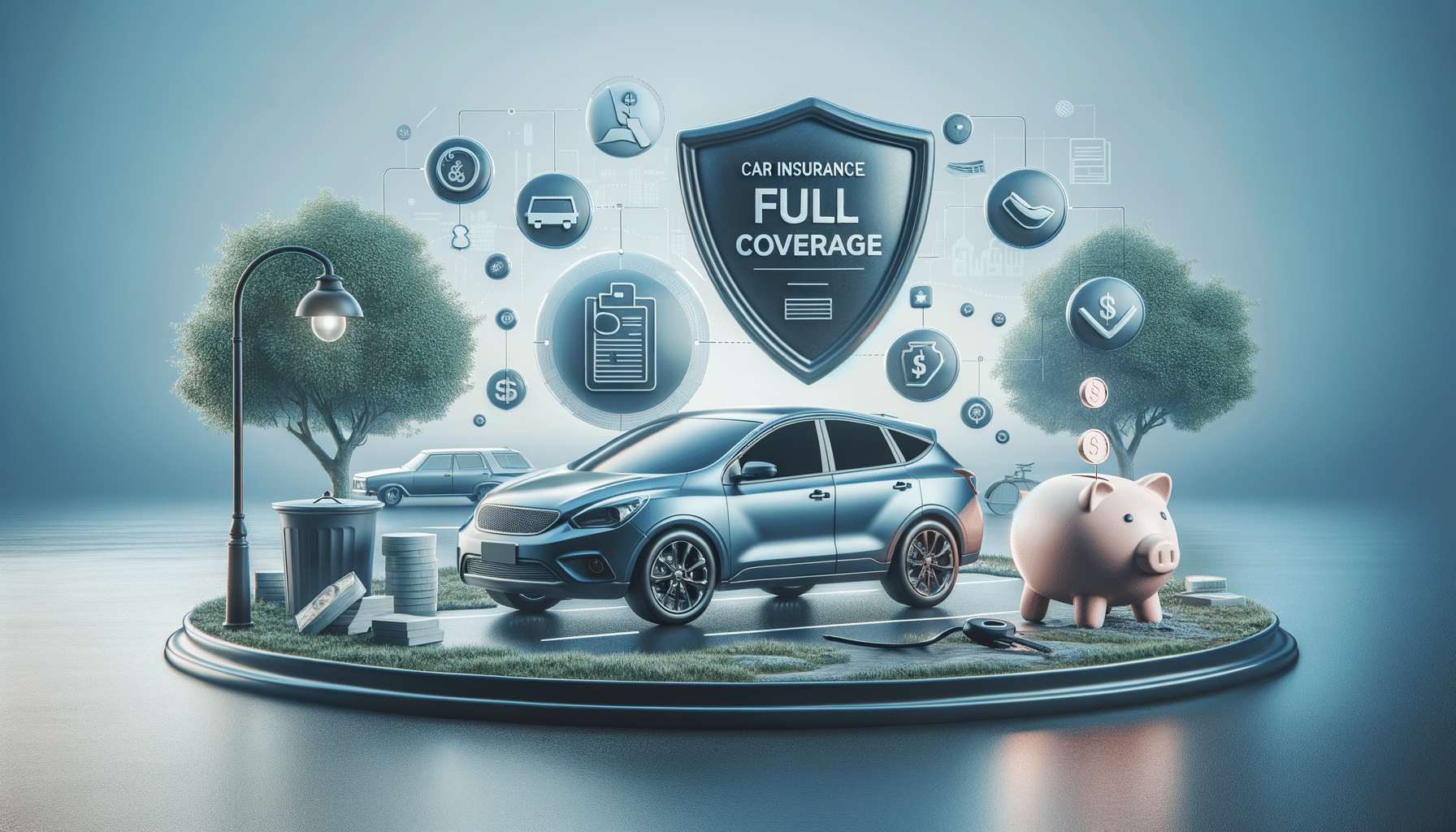

Introduction: Navigating Car Insurance for Seniors Over 70

As individuals age, their needs and circumstances change, and this is particularly true when it comes to car insurance. For seniors over 70, finding affordable car insurance that offers full coverage can be a challenging task. This demographic often faces higher premiums due to perceived risks, but there are ways to manage these costs effectively. In this article, we will explore the various aspects of securing affordable full coverage car insurance for seniors over 70, offering insights and practical tips to help navigate the insurance landscape.

Understanding Full Coverage Car Insurance

Full coverage car insurance is a term that typically refers to a combination of different types of coverage that protect both the vehicle and the driver. For seniors over 70, understanding what full coverage entails is crucial to making informed decisions. Full coverage usually includes:

- Liability Coverage: This covers damages to others if you are at fault in an accident.

- Collision Coverage: This covers damages to your own vehicle in the event of an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers non-collision related damages, such as theft, vandalism, or natural disasters.

For seniors, having full coverage can provide peace of mind, knowing that they are protected in various scenarios. However, it is important to evaluate the necessity of each type of coverage based on individual circumstances and vehicle value. Seniors often drive less, which may influence the level of coverage needed.

Factors Affecting Insurance Rates for Seniors

Insurance rates for seniors over 70 can be influenced by several factors. Understanding these can help in finding more affordable options. Key factors include:

- Driving Record: A clean driving record can significantly lower insurance premiums, as it indicates a lower risk to insurers.

- Vehicle Type: The make and model of the vehicle can affect insurance costs. Generally, cars with higher safety ratings may lead to lower premiums.

- Location: Where you live can impact your insurance rates. Areas with higher traffic or accident rates may result in higher premiums.

- Annual Mileage: Seniors often drive less than younger individuals, which can be beneficial in reducing insurance costs.

By understanding these factors, seniors can take proactive steps to potentially reduce their insurance costs, such as maintaining a good driving record and considering vehicles with strong safety features.

Tips for Finding Affordable Full Coverage

Finding affordable full coverage car insurance for seniors over 70 requires a strategic approach. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurance providers to find the most competitive rates.

- Look for Discounts: Many insurers offer discounts for seniors, safe drivers, or those who bundle multiple policies.

- Consider Usage-Based Insurance: Some insurers offer policies that base premiums on actual driving habits, which can be cost-effective for seniors who drive less.

- Review Coverage Needs: Regularly assess your coverage needs to ensure you are not over-insured or paying for unnecessary coverage.

By implementing these strategies, seniors can better manage their insurance costs while ensuring they have adequate protection.

Conclusion: Securing Peace of Mind

For seniors over 70, securing affordable full coverage car insurance is not just about finding the lowest price but also about ensuring peace of mind on the road. By understanding the components of full coverage, the factors influencing rates, and employing cost-saving strategies, seniors can effectively navigate the insurance landscape. It is essential to remain informed and proactive, regularly reviewing insurance needs and options to ensure that coverage remains both comprehensive and affordable.