A Guide to Managing Your Finances in 2025

Introduction: Navigating Financial Management in 2025

As we step into 2025, managing personal finances has become more complex yet more accessible than ever before. With the rapid advancement of technology and the ever-changing economic landscape, individuals must adapt their financial strategies to stay ahead. This guide aims to provide practical insights and strategies to help you effectively manage your finances in 2025, ensuring financial stability and growth.

Budgeting: The Foundation of Financial Management

Budgeting remains a cornerstone of financial management, even as we enter 2025. A well-structured budget allows you to track income and expenses, ensuring that you live within your means and save for future goals. In the digital age, budgeting apps and tools have made it easier to automate and monitor your financial activities. These tools can categorize your spending, provide visual insights, and help you identify areas where you can cut costs.

When creating a budget, consider the following steps:

- Identify your sources of income.

- List all monthly expenses, including fixed and variable costs.

- Set savings goals and allocate a portion of your income towards them.

- Regularly review and adjust your budget to reflect changes in your financial situation.

By maintaining a disciplined approach to budgeting, you can avoid unnecessary debt and build a solid financial foundation for the future.

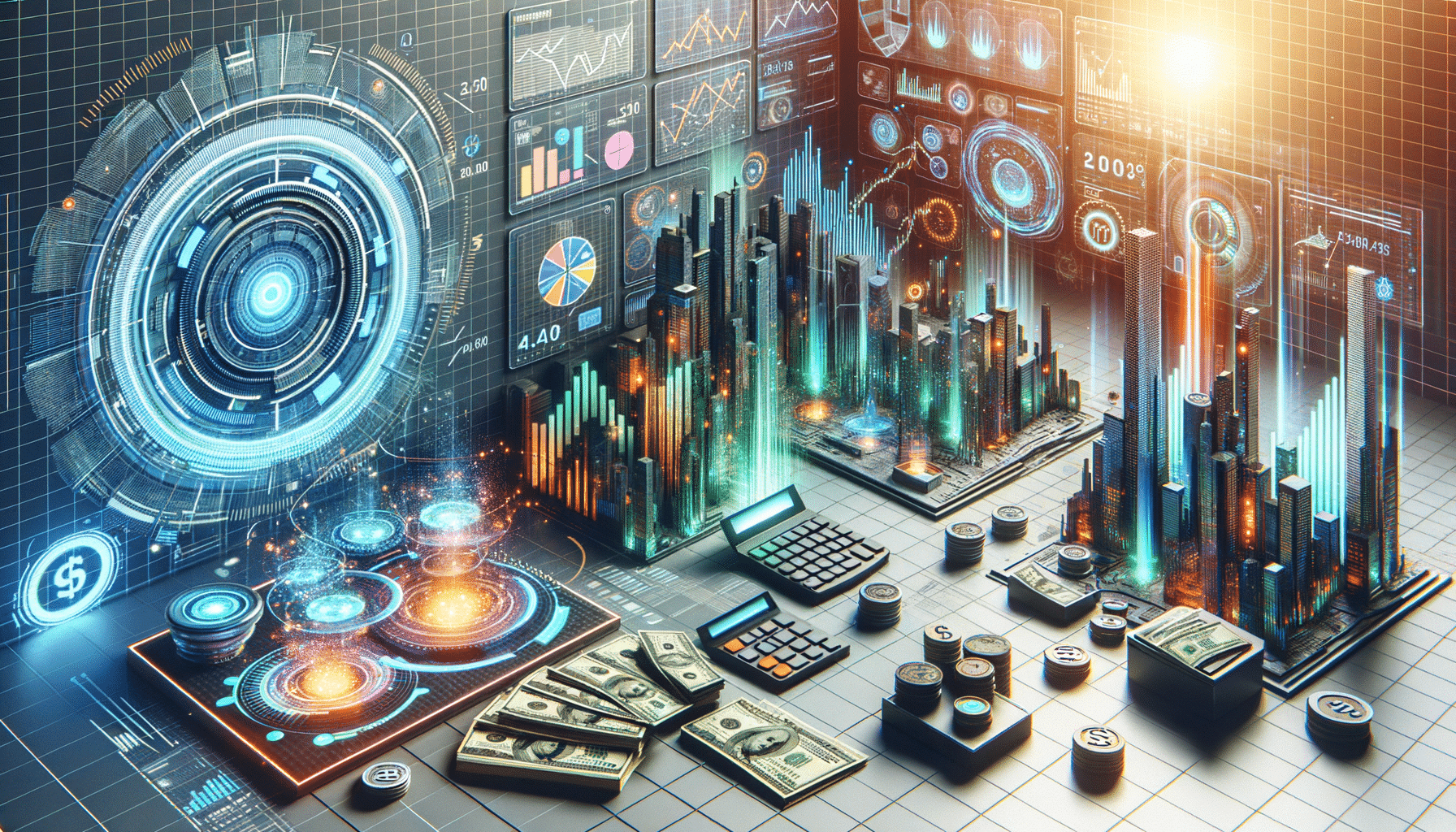

Investing: Building Wealth for the Future

Investing is a crucial component of financial management that can significantly impact your long-term wealth. In 2025, the investment landscape is more diverse, with opportunities ranging from traditional stocks and bonds to cryptocurrencies and real estate. Understanding your risk tolerance and investment goals is essential in crafting a portfolio that aligns with your financial aspirations.

Consider these investment strategies:

- Diversification: Spread your investments across various asset classes to minimize risk.

- Long-term perspective: Focus on long-term growth rather than short-term gains.

- Stay informed: Keep up with market trends and economic indicators to make informed decisions.

By following these strategies, you can build a robust investment portfolio that supports your financial goals and adapts to market changes.

Embracing Technology: The Role of Fintech in Financial Management

Technology continues to revolutionize the way we manage our finances. In 2025, fintech solutions offer innovative ways to handle financial transactions, investments, and savings. From mobile banking apps to automated investment platforms, technology provides convenience and efficiency in financial management.

Key fintech trends to consider include:

- Robo-advisors: Automated platforms that offer personalized investment advice based on your financial goals.

- Blockchain technology: Ensures secure and transparent financial transactions.

- Artificial Intelligence: Enhances financial analysis and decision-making processes.

By leveraging these technological advancements, you can streamline your financial management and stay ahead in a digital world.

Conclusion: Achieving Financial Success in 2025

Managing your finances in 2025 requires a proactive approach that combines traditional financial principles with modern technological tools. By focusing on budgeting, investing wisely, and embracing fintech innovations, you can achieve financial stability and growth. The key is to stay informed, adaptable, and disciplined in your financial practices, ensuring a prosperous future in an ever-evolving economic landscape.